UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| |||

Filed by the Registrant ☑ |

| ||

Filed by a Party other than the Registrant | ☐ | ||

| ||||||

| ||||||

☐ | Preliminary Proxy Statement | |||||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

☑ | Definitive Proxy Statement | |||||

☐ | Definitive Additional Materials | |||||

☐ | Soliciting Material | |||||

HALLADOR ENERGY COMPANY

(Name of Registrant as Specified in Its Charter)(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| |||||||||

| ☒ | No fee | |||||||

☐ | Fee paid previously with preliminary materials | ||||||||

☐ | Fee computed on table | ||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

| ||||||||

|

| ||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

April 9, 2018

NOTICE OF

2024ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 30, 2024

As a shareholder of Hallador Energy Company,

1183 East Canvasback Drive

Terre Haute, IN 47802

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 30, 2024

Dear Fellow Shareholders,

It is our pleasure to invite you are hereby given notice of, and invited to attend in person or by proxy, Hallador Energy Company’s 2018our 2024 Annual Meeting of Shareholders (the “2018(our "Meeting" or "2024 Annual Meeting”Meeting"). The 2018 Annual Meeting will to be held at the offices of Yorktown Partners, LLC, 410 Park Avenue, 19th Floor, New York City, New York 10022 on Wednesday, May 23, 201830, 2024, at 10:3000 a.m. Eastern Daylight Time, for at our offices at 1183 East Canvasback Drive, Terre Haute, Indiana 47802. The purpose of the following purposes:Meeting is to:

1. |

|

2. |

|

3. |

|

4. | Transact such other |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. The Board of Directors has fixed the close of business on March 29, 2018April 10, 2024, as the record date for the determinationdetermining shareholders of shareholdersHallador Energy Company entitled to receive notice of and to vote at the 20182024 Annual Meeting and any adjournment or postponement thereof.

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials primarily via the Internet, rather than mailing paper copies of these materials to each shareholder. On or about April 9, 2018, we began mailing a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access the proxy materials, submit your proxy, and request paper copies of the proxy materials. We believe this process expedites shareholders’ receipt of the proxy materials, lowers the cost of our 2018 Annual Meeting through lower printing and distribution costs, and reduces the environmental impact associated with printing a large volume of proxy materials. Your vote is important. We urge you to review the Proxy Statement carefully and to submit your proxy or voting instructions as soon as possible so that your shares will be represented at the meeting.

WHETHER OR NOT YOU EXPECT TO ATTEND THE 2024ANNUAL MEETING IN PERSON, WE URGE YOU TO VOTE YOUR SHARES VIA THE TOLL-FREE TELEPHONE NUMBER OR OVER THE INTERNET, AS PROVIDED IN THE ENCLOSED MATERIALS. IF YOU REQUESTED A PROXY CARD BY MAIL, YOU MAY SIGN, DATE, AND MAIL THE PROXY CARD IN THE ENVELOPE PROVIDED.

Thank you for your continued interest and support.

By Order of the Board of Directors, | |

| |

| |

Corporate Secretary | |

| |

|

1660 Lincoln Street, Suite 2700, Denver, Colorado 80264

1

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 30,2024.

The Notice of Annual Meeting, Proxy Statement, and Annual Report for the fiscal year ended December 31, 2023, are available at http://materials.proxyvote.com/40609P.

IMPORTANT NOTICE REGARDING ADMISSION TO THE 2024ANNUAL MEETING

We ask that shareholders or their legal proxy holders who wish to attend the 2024 Annual Meeting register with Investor Relationsno later than May21, 2024,

by email to investorrelations@halladorenergy.com or by telephone at (303) 839-5504.

|

|

HALLADOR ENERGY COMPANY

PROXY STATEMENT

3FOR THE ANNUAL MEETING OF SHAREHOLDERS

|

TO BE HELD MAY 30, 2024

This Proxy Statement is being furnished by the Board of Directors (the “Board”"Board") of Hallador Energy Company (the “Company”"Company", "Hallador", "we" or "us") to holders of our common stock in connection with the solicitation by the Board of proxies to be voted at the 20182024 Annual Meeting of Shareholders (the “Meeting”(our "Meeting" or “2024 Annual Meeting”).)

Date and Location of Meeting

Our Meeting will be held on Wednesday, May 23, 201830, 2024, at 10:3000 a.m. Eastern Daylight Time, at theour offices of Yorktown Partners, LLC, 410 Park Avenue, 19th Floor, New York City, New York 10022, at 1183 East Canvasback Drive, Terre Haute, Indiana 47802, or at such other time and place inif the event that the meetingMeeting is postponed or adjourned. References in this Proxy Statement to the 20182024 Annual Meeting also refer to any adjournments, postponements, or changes in time or location of the meeting,Meeting, to the extent applicable.

Who can attend the Meeting?

We invite all HalladorAll of our shareholders as of the Record Date or their named representatives and membersclose of their immediate familybusiness on April 10, 2024, may attend the 2024 Annual Meeting.

What do I need to do to attend the Meeting. We reserve the right to limit the number of representatives who may attend. Meeting?

Proof of ownership, andtogether with valid government-issued photo identification issuch as a driver's license or passport, are required to attend the Meeting. A recent brokerage statement or a letter from your bank or broker are examples of proof of ownership. Cameras, recording devices, and other electronic devices are not allowed at the Meeting.

We ask that you RSVPshareholders or their legal proxy holders who wish to Halladorattend the 2024 Annual Meeting register with Investor Relationsno later than May21, 2024, by May 18, 2018, via email to investorrelations@halladorenergy.com attention Rebecca Palumbo or by telephone to 1-800-839-5506, ext. 316. at (303) 839-5504.

For safety reasons, we will not allow anyone to bring large bags, briefcases, packages, or other similar items into the Meeting, or to record or photograph the Meeting.

What is the purpose of the Meeting?

At the Meeting, our shareholders will act upon the matters outlined in the “Notice"Notice of Annual Meeting”,Meeting," which appears on the cover page of this Proxy Statement, includingincluding:

1. |

|

2. |

|

3. | Ratify the appointment of Grant Thornton LLP, as our independent registered public accounting firm for 2024; and | |

4. |

|

DELIVERY OF THE PROXY MATERIALS

Mailing Date

On or about April 9, 2018,19, 2024 we mailed a Notice of Internet Availability of Proxy Materials (the “Notice"Notice of Availability”Availability") to our shareholders containing instructions on how to access the proxy materials and submit your proxy online. We have made these proxy materials available to you over the Internet or, upon your request, have delivered paper copies of these materials to you by mail, in connection with the solicitation of proxies by the Board for the 2018 Annual Meeting.

Shareholders Sharing an Address

Registered Shareholders—Each registeredrecord shareholder (meaning you own shares in your name on the books of our transfer agent, Computershare Trust Company, N.A.) will receive one Notice of Availability, regardless of whether you have the same address as another registeredrecord shareholder.

Street Name Shareholders—If youryou own shares are held in “street name”"street name" (that is, in the name of a bank, broker, or otheranother holder of record), applicable rules permit brokerage firms and our company,Company, under certain circumstances, to send one Notice of Availability to multiple shareholders who share the same address. This practice is known as “householding.”"householding." Householding saves printing and postage costs by reducing duplicate mailings. If you hold your shares through a broker, you may have consented to reducingreduce the number of copies of materials delivered to your address. If you wish to revoke a “householding”"householding" consent you previously provided to a broker, you must contact that broker to revoke your consent. If your household is receiving multiple copies of the Notice of Availability and you wish to request delivery of a single copy, you should contact your broker directly.

VOTING INFORMATION

Who is entitled to vote?

Only shareholders of record at the close of business on March 29, 2018April 10, 2024, (the “Record Date”"Record Date"), are entitled to receive notice of the Meeting and to vote the shares of common stock of the Company (“("Common Stock”Stock"). The holders of the Common Stock may vote on all matters presented at the Meeting and will vote together as a class. Each outstanding share of Common Stock entitles the holder to one vote. As of the Record Date, there were 29,955,71336,532,019 shares of Common Stock outstanding.

As of the Record Date, the Company's officers and directors are the record and beneficial owners of a total of 13,502,21811,799,336 shares (45.1%(32.30%) of the Company's outstanding common stock.Common Stock. Management intends to vote all of its shares in the manner recommended by the Board for each matter to be considered by the shareholders.

What constitutes a quorum?

One-third of the outstanding common shares of Common Stock entitled to vote, represented in person or by proxy, constitutes a quorum for the Meeting.

Is my vote confidential?

Yes. All proxies, ballots, and vote tabulations that identify how individual shareholders voted will be kept confidential and will not be disclosed to our directors, officers, or employees, except in limited circumstances, including:

● | When disclosure is required by law; | |

● | During any contested solicitation of proxies; or | |

● | When written comments by a shareholder appear on a proxy card/voting instruction form or other voting material. |

How do I vote?

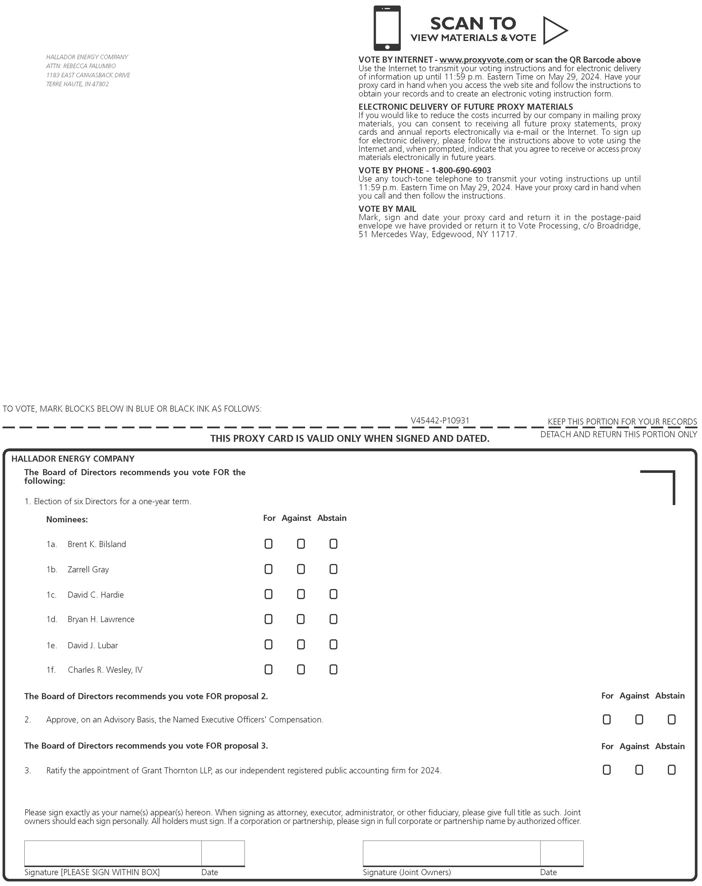

OurShareholders of record may vote using one of the following methods:

● | over the Internet, which you are encouraged to do so if you have access to the Internet; | |

● | by telephone; | |

● | by completing, signing, and returning the included proxy card, for those who requested to receive printed proxy materials in the mail; or | |

● | by attending the 2024 Annual Meeting and voting in person. |

The Notice of Availability provides instructions on how to access your proxy, materialswhich contains instructions on how to vote via the Internet or by telephone. For shareholders who request to receive a paper proxy card in the mail, instructions for voting via the Internet, by telephone, or by mail are availableset forth on the proxy card.

If you hold shares in "street name", the organization holding your account is considered the shareholders of record for purposes of voting at the Meeting. The shareholder of record will provide you with instructions on how to vote your shares. Internet and telephone voting will be offered to shareholders onowning shares through most brokerage firms and banks. Additionally, if you would like to vote in person at the InternetMeeting, contact the brokerage firm, bank or other nominee who holds your shares to obtain a proxy from them and by mail. bring it with you to the Meeting. You will not be able to vote at the Meeting unless you have a proxy from your brokerage firm, bank,or other nominee.

You may read, print, and download our 20172023 Form 10-K, 20182024 Proxy Statement and Proxy Card at http://materials.proxyvote.com/40609P. On an ongoing basis, shareholders may request to receive proxy materials in printed form by mail or electronically by e-mail. You may vote your shares by the Internet, by regular mail or in person at the Meeting. Each of these voting options is described in the Notice of Availability and the Proxy Card.email.

To ensure that your vote is counted at the Meeting, regardless of whether you plan to attend, you should vote by using the Internet or telephone voting optionoptions on your Proxy Card or by mailing in your Proxy Card. If you return an executed Proxy Card without marking your instructions, your executed Proxy Card will be voted by the recommendations of the Board. In connection therewith, the Board has designated Brent K. Bilsland, Chairman, President and CEO, and Lawrence D. Martin,Marjorie Hargrave, CFO, as proxies. If you indicate a choice concerning any matter to be acted upon on your proxy cardProxy Card or voting instruction card, your shares will be voted per your instructions.

Information for Beneficial Owners

If you hold your Hallador shares inAs a brokerage, bank or other institutional account, you are considered the beneficial owner, of thosein order to ensure your shares but notare voted in the record holder. This means thatway you vote by providingwould like, you must provide voting instructions to your bank, broker rather than directlyor other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee. If you do not provide voting instructions to your bank, broker or other nominee, whether your shares can be voted by such bank, broker or nominee depends on the Company. Unless you providetype of item being considered for vote.

Non-Discretionary (Non-Routine) Items. The election of directors (Proposal 1) and the Advisory Vote Approving the Named Executive Officers' Compensation (Proposal 2) are non-discretionary items and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions your brokerfrom beneficial owners.

Discretionary (Routine) Items. The ratification of the appointment of Grant Thornton LLP as independent registered public accounting firm is a discretionary item, also known as a “routine” matter. Generally, brokers, banks and other nominees that do not permitted to vote your shares on your behalf. For yourreceive voting instructions from beneficial owners may vote on any other matters to be counted, you will need to communicate your voting decisions to yourthis proposal in their discretion.

When a broker, bank or other institution before the date of the Meeting using the voting instruction form that the institution providesnominee votes its clients’ unvoted shares on “routine” matters, these shares are counted to you. If you would likedetermine if a quorum exists to vote your sharesconduct business at the meeting, you must obtainMeeting. A broker, bank or other nominee cannot vote clients’ unvoted shares on non-routine matters, which results in a proxy from your financial institution and bring it with you to hand in with your ballot.

5

What if I do not specify how my shares are to be voted?

For “Proposal No. 1 – Election of Directors,” if you submit a proxy but do not indicate any voting instructions, your shares will be voted in accordance with the recommendations of the Company’s Board of Directors (the “Board”)“broker non-vote”.

For “Proposal No. 2 –Advisory Vote Approving Named Executive Officers’ Compensation,” if you submit a proxy but do not indicate any voting instructions, your shares will be counted as a vote approving the compensation of the Company’s Named Executive Officers.

Can I change my vote after I returnor revoke my proxy card?proxy?

Yes. Even afterIf you have submitted your Proxy Card,are a shareholder of record, you may change your vote or revoke your proxy at any time before your shares are voted at the Meeting by:

● | Notifying our Corporate Secretary in writing at our address above that you are revoking your proxy; | |

● | Executing and delivering a later-dated proxy card or submitting a later-dated vote by telephone or the Internet; or | |

● | Attending the Meeting in person, revoking your proxy, and voting in person. |

Attendance at the Meeting will not cause your previously granted proxy is exercised by filing with the Secretary of the Company at our address above either a notice of revocation or a duly executed proxy bearing a later date.to be revoked unless you specifically make that request. If you attendhold your shares in "street name," you may submit new voting instructions by contacting your bank, broker, or other nominee, or if you have obtained a legal proxy from your bank, broker or other holder of record giving you the right to vote your shares, by attending the Meeting in person you may revoke your proxy and votevoting in person.

What if other matters come up at the Meeting?

The matters described in this Proxy Statement are the only matters we know that willto be voted on at the Meeting. If other matters are properly presented at the Meeting, the proxy holders will vote your shares as they see fit.

Can I vote in person at the Meeting rather than by completing the Proxy Card?

Although we encourage you to complete and return the Proxy Card to ensure that your vote is counted, you can attend the Meeting and vote your shares in person.

How are votes counted?counted?

We will hold the Meeting if holders of one-third of the total shares of Common Stock that are entitled to vote either sign and return their Proxy CardsCard or attend the Meeting. If you sign and return your Proxy Card, your shares will be counted to determine whether the Company has a quorum even if you abstain or fail to vote on any of the proposals listed on the Proxy Card.

Where can I find the voting results of the Annual Meeting?

We willplan to announce the preliminary voting results at the Meeting. The2024 Annual Meeting and to publish final voting results will reported in a Current Report on Form 8-K which we are required to filefiled with the SECSecurities and Exchange Commission (the "SEC") within four business days followingafter the 2024 Annual Meeting.

Who pays for this proxy solicitation?

The CompanyWe will paybear all of the solicitation costs and will supply copies of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Proxy Card, and any additional solicitation materials furnished to shareholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. Also, the Companywe may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. In addition to sending you these materials, some of the Company’sCompany's employees may contact you by telephone, by mail, or in person. None of these employees will receive any extra compensation for doing this.

What vote is required to approve each item?

Election of Directors. At the Meeting, fivesix director-nominees are standing for election to the Board. With respect to the election of directors, you may vote "for" or "against" each of the nominees for the Board, or you may "abstain" from voting for one or more nominees. To be elected to the Board, each director-nominee must receive the affirmative vote of the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter (meaning that of the shares represented at the Meeting and entitled to vote, a majority of them must be voted "FOR" the nominee). Abstentions will have the same effect as a vote "against" the election of the nominee to the Board. Your broker may not vote your shares on the nominees unless you give voting instructions. Broker non-votes will have no effect on the election of the nominees. Each director-nominee elected at the Meeting will serve on the Board for a one-year term or until his successor is duly elected and qualified. Director-nominees will be elected by majority of the votes cast by holders of the Common Stock, represented in personqualified, or by proxy at the Meeting. This means that the director-nominees will be elected if they receive more votes cast for than against his election. A properly executed proxy marked “Withheld” with respect to the election of any director-nominee will not be voted with respect to such director-nominee indicated, although it will be counted for purposes of determining whether thereuntil he resigns or is a quorum. removed.

Say-on-Pay. At the Meeting, we are asking shareholders to vote to approve on an advisory basis on the compensation paid to the Named Executive Officers. With respect to this proposal, you may vote "for," "against," or "abstain" from voting with respect to this proposal. A majority of the shares of Common Stock represented at the Meeting and entitled to vote on this proposal must vote FOR"FOR" the proposal to approve it. If you "abstain" from voting with respect to this proposal, your vote will have the same effect as a vote "against" the proposal. Your broker may not vote your shares on this proposal unless you give voting instructions. Broker non-votes do not affectwill have no effect on the vote.vote for this proposal. Your vote will not directly affectchange or otherwise limit

6

or enhance any existing compensation or award arrangement of any of our named executive officers,Named Executive Officers, but the outcome of the say-on-pay vote will be taken into account by the Compensation and Nominating Committee when considering future compensation arrangements.

Ratification of Auditor. At the Meeting, we are asking shareholders to ratify the appointment of Grant Thornton LLP, as our independent registered public accounting firm for the year ending December 31, 2024. With respect to this proposal, you may vote "for," "against" or "abstain" from voting with respect to this proposal. A majority of the shares represented at the Meeting and entitled to vote on this proposal must vote "FOR" the proposal to approve it. If you "abstain" from voting with respect to this proposal, your vote will have the same effect as a vote "against" the proposal. As this proposal is considered a "routine" matter, your broker may vote your shares on this proposal if you do not provide voting instructions.

Other Matters.For most other matters that properly come before the Meeting, the affirmative vote of a majority of shares of Common Stock, present in person or represented by proxy and voted at the Meeting, will be required.

Hallador is led by Brent K. Bilsland, our Chairman, President, and Chief Executive Officer, whose biography appears below under "Our Current Board of Directors and Nominees;" Marjorie Hargrave, our Chief Financial Officer, and Heath A. Lovell, our President of Hallador Power, whose biographies appear under "Our Named Executive Officers Who Are Not Directors."

PROPOSAL NO. 1: ELECTION OF DIRECTORS.DIRECTORS FOR A ONE-YEAR TERM.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" ALL OF THE NOMINEES.

At our 20172023 Annual Meeting of Shareholders, our shareholders elected a Board of sevensix directors. Two of our directors elected at that meeting have passed away; John Van Heuvelen on May 17, 2017, and Victor P. Stabio, our Chairman of the Board, on March 7, 2018. The Board has decided not to fill the vacancies and reduce the board size to five members.

OurFive of our current directors are listed below and nominated for re-election, and one new nominee is seeking election at the Meeting. One of our current directors, Steven R. Hardie, is not standing for re-election and will be retiring from the Board when his current term expires at the Meeting. Hallador would like to thank Mr. Hardie for his guidance and valuable contributions during his many years of dedicated service on the Board.

Each of the directors elected at the Meeting will serve a one-year term expiring at the next annual meeting of shareholders or until their successors have beenare duly elected and qualified, or until he resigns or is removed. Each nominee agreed to be named in this proxy statementProxy Statement and to serve if elected.

Under Hallador’s Bylaws,To be elected to the Board, each director-nominee must receive the affirmative vote of the holders of a majority of shares present in an uncontestedperson or represented by proxy at the Meeting. Abstentions will have the same effect as a vote "against" the election directors are elected by plurality of votes cast with respectthe nominee to such director, meaning that the number of votes cast “for” a director must exceed the number of votes cast “against” that director.Board. Your broker may not vote your shares on this proposalthe nominees unless you give voting instructions. Abstentions andThus, broker non-votes will have no effect on the vote for this proposal. If you sign your Proxy Card but do not affectgive instructions with respect to the vote. voting of director-nominees, your shares will be voted for the nominees. Each director-nominee elected at the Meeting will serve on the Board for a one-year term or until his successor is duly elected and qualified, or until he resigns or is removed.

Any director-nominee who is currently serving as a director and who receives a greater number of votes “against” his or her election than votes “for” in an uncontested electiondoes not meet the voting requirement described above must tender his or her resignation.

We have no reason to believe that any of the nominees will be unable or unwilling for good cause to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, the proxies may be voted for another person nominated as a substitute by the Board, or the Board may reduce the number of Directors.directors.

Information about the Director NomineesOUR CURRENT BOARD OF DIRECTORS AND NOMINEES

Below is information aboutan overview of our current directors and each nominee, including biographical data for at least the past five years and an assessment of the skills and experience of each nominee. director nominees you are being asked to elect at the 2024 Annual Meeting.

|

|

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Name and Principal Occupation | Age | Board Member Since | Independent | Audit Committee | Compensation Committee | Nominating Committee | |

Brent K. Bilsland Chairman of the Board, President and CEO Hallador Energy Company | 50 | 2009 | |||||

Zarrell Gray Executive Advisor to Teays Rivers | 57 | ✔ | |||||

David C. Hardie Executive Chairman of the Board Hallador Investment Advisors Inc. | 73 | 1989 | ✔ | Chair | ✔ | ✔ | |

Steven R. Hardie** Managing Member NextG LLC | 69 | 1994 | ✔ | ✔ | ✔ | ||

Bryan H. Lawrence Managing Member of Yorktown Partners LLC | 81 | 1995 | ✔ | ✔ | ✔ | ✔ | |

David J. Lubar Director, CEO and President Lubar & Co. | 69 | 2018 | ✔ | ✔ | Chair | ✔ | |

Charles R. Wesley, IV President Thoroughbred Resources LP | 45 | 2018 | ✔ | Chair | |||

Total Committee Meetings in 2023 | 4 | 1 | 0 |

**Mr. Steven Hardie is not standing for re-election.

BRENT K. BILSLAND, the Chairman of the Board, President, and CEO.On March 9, 2018,CEO, has served on the Board since 2009. Mr. Bilsland assumed the role ofwas elected Chairman of the Board in addition to his role as President2018, appointed CEO in 2014, and CEO. Mr. Bilsland has been a director and our President since 2009 and our CEO since January 2014.2009. He was President of Sunrise Coal, LLC, our primary operating subsidiary, from July 2006 through November 2017. Previously, Mr. Bilsland was2017, and Vice President of Knapper Corporation, a private corporation, from 1998 to 2004. Mr. Bilsland is a graduate of Butler University located in Indianapolis, Indiana.

Mr. Bilsland brings broad industry experience and significant operational capabilities to our Company. He has an intimate understanding of our business and its operations that benefitsbenefit us. Mr. Bilsland’s personal investment in Hallador stock, combined with his wife and children, is 3.9% (1,162,455 shares) in addition to his 275,000 RSUs that will lapse/vest equally over four years beginning December 2018. Mr. Bilsland currently serves as a director of both the

7

National Mining Association (NMA) and the Indiana Coal Council (ICC). In 2015 and 2016, Mr. Bilsland served as the Chairman of the ICC.Indiana Coal Council. Mr. Bilsland's investment in our Common Stock, combined with his wife and children, is 3.88%.

DAVID C. HARDIE, Director ZARRELL GRAY,Executive Advisor to Teays Rivers, a U.S. holding company with a strategic focus on production based and vertically integrated agricultural businesses with assets and operations across 23 states and 10 countries. From 2007 to 2021 he was Executive Vice President and Chief Operating Officer at Teays River. Prior to joining Teays River, Mr. Gray was professionally involved in the hybrid seed industry for over 17 years (1990 to 2007) and remains a principal owner of Gray's Seed, Inc. Mr. Gray graduated from Purdue University and has a Bachelor of Science in Agricultural Economics.

Mr. Gray brings more than 16 years as a senior executive (COO/EVP) in the formation and growth of a large-scale holding company. Mr. Gray has served on multiple private corporate boards each with sales in the hundreds of millions or greater. He also has extensive experience in investment committees, diligence processes, and various acquisition execution responsibilities and has been engaged in raising capital and debt facilities, each in excess of a billion dollars. Over his career he developed a unique and broad global network of investors, bankers and operators. We believe that Mr. Gray's vast experience will enable us to advance our board since 1989. He is also thelong-term strategic growth plan.

DAVID C.HARDIE, a Director, serves as Chair of our Audit and Compensation and Nominating committees.Committee. From July 1989 through January 2014, Mr. Hardie was our Chairman of the Board. He is the Executive Chairman of the Board and Chief Executive Officerboard of directors of Hallador Investment Advisors Inc., which manages Hallador Cash Fund LP, Hallador Alternative Assets Fund, Moka Fund, and Hallador Balanced Fund. Mr. Hardie is andalso the Managing Member of Allora, a fine dining restaurant in Sacramento, California. Mr. Hardie joined the board of directors of Earlens Corporation, a venture-backed hearing aid company, in November 2020. He serves as a director and partner of other private entities that are owned by members of his family and also serves as Chairmandirector of The Parasol Tahoe Community Foundation.Foundation and University of California Davis Environmental Research Center. Mr. Hardie is a graduateGraduate of California Polytechnic University, San Luis Obispo.Obispo with a Bachelor of Science in Accounting. He also attendedcompleted the Owner/President Management program at the Harvard Business School.

STEVEN HARDIE, Director,has served onMr. David C. Hardie, who controls 6.31% of our board since 1994. He is manager of NextG LLC a family investment partnership formed in 2016. For the past 32 years, heCommon Stock, has been a private investor and serves as director and partner of other private entities owned by members of his family.

Messrs. David and Steven Hardie have served as our board membersBoard member for the last 29 and 24 years, respectively. Both have been private investors in many companies over their careers and served on numerous boards. At one time, the two brothers and their family owned over 50% of our common stock.

Currently, the two brothers beneficially own through various entities 11.4% of our common stock giving them a vested interest in monitoring the well-being of our Company, although Messrs. David and Steven Hardie disclaim any beneficial ownership of any other shares held by such entities. Their35 years. His significant broad experience, as well as an intimate knowledge of our Company, areis a tremendous benefitsbenefit to us in planning and executing our corporate strategy.

BRYAN H. LAWRENCE, a Director,has served on our board since November 1995. Mr. Lawrence is a founder and senior manager of Yorktown Partners LLC, the manager of the Yorktown group of investment partnerships, which make investments in companies engaged in the energy industry. The Yorktown partnerships were formerly affiliated with the investment firm of Dillon, Read & Co. Inc., where Mr. Lawrence had been employed since 1966, serving as a Managing Director until the merger of Dillon Read with SBC Warburg in September 1997. Mr. Lawrence also serves as a director of Carbon Natural Gas Company,Riley Exploration Permian, Inc., Ramaco Resources, Inc., and Star Group, L.P.LP (each a United States publicly tradedpublicly-traded company) and certain non-public companies in the energy industry in which Yorktown partnerships hold equity interests. Mr. Lawrence is a graduate of Hamilton College and also has an M.B.A.MBA from Columbia University.

Mr. Lawrence, who controls 19.6%1.37% of our stock,Common Stock, has been a boardBoard member for the last 2329 years. He sitsWe believe that Mr. Lawrence's wealth of industry-specific transactional skills and experience qualifies him to serve on numerous boards for both private and public companies that are involved in the energy business. His experience with us and in other energy companies, gives us a significant benefit.our Board. As with most of our other boardBoard members, he too has a significant indirect monetary investment in our Company and accordingly has a vested interest in our success.

SHELDON B.DAVID J. LUBAR, a Director,has served on our board since 2008. Since 1977, Mr. Lubar has been Chairman of the Board is President and CEO of Lubar & Co. Incorporated, He began his career in 1977 at Wells Fargo Bank (f/k/a private investmentNorwest Bank N.A.) in Minneapolis, where he spent six years in commercial and venture capital firm he founded. Duringcorrespondent banking. Mr. Lubar joined Lubar & Co. in 1983 and has served as lead investor to over 20 companies in a wide range of industries and various stages of development. He currently serves as a director of each of the past five years, he served on the board of Approach Resources, Inc.Lubar Companies as well as Nicholas Company, Baird Funds, Ixonia Bank (chairman), Crosstex Energy, Inc., Crosstex Energy L.P.,Milwaukee Brewers Baseball Club, and several other private companies. Mr. Lubar currently serves on the board of Star Gas Partners L.P. andHe previously served on the boards of a number of private companies.BMO Financial Corp and Northwestern Mutual Life Insurance Company. He also serves in many community leadership positions throughout the Milwaukee area. Mr. Lubar has a Bachelor of Arts degree from Bowdoin College and Master of Business Administration from the University of Minnesota.

Mr. David J. Lubar controls 14.92% of our Common Stock. Mr. Lubar has 40 years of investment experience with private companies, public stocks, and fixed income. His experience provides him insight from the view of an investor and Board member.

CHARLES R WESLEY, IV, a Director, has served as President of Thoroughbred Resources LP (a Yorktown Partners affiliate) since 2014 and CEO since 2016. Mr. Wesley served as Chief Planning and Commercial Officer of Ramaco Resources and, before joining Thoroughbred, Senior Director of Finance and Senior Counsel at Lumen Technologies (formerly Level 3 Communications), where he was also responsible for the operation and ultimate disposition of the Company's coal mining operations. Prior to Lumen Technologies, he worked at the law firms of Akin, Gump, Strauss, Hauer & Feld, and Strasburger & Price, focusing on international energy transactions. He began his career with a coal company as a mining engineer and is an active investor in natural resources and financial technology. Mr. Wesley is a board member across multiple industries and philanthropic organizations. Mr. Wesley holds a bachelor'sJuris Doctorate from the University of Kentucky College of Law and a Bachelor of Science in Mining Engineering from Virginia Polytechnic Institute.

Mr. Wesley brings a wealth of invaluable coal mining industry knowledge and experience to the Board. His vast knowledge of the industry assists the Board in driving future and potential growth and expansion opportunities.

Non-Continuing Director

STEVEN R. HARDIE,a Director, has served on the Board since 1994. He is the manager of NextG LLC, a family investment partnership formed in 2016. For the past 38 years, he has been a private investor and serves as director and partner of other private entities owned by members of his family. Mr. Hardie is not standing for re-election and will be retiring from the Board when his current term expires at the Meeting.

OUR NAMED EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

On March 25, 2024, the Company appointed Marjorie Hargrave as its new Chief Financial Officer, effective April 10, 2024, to succeed Lawrence D. Martin. Because Ms. Hargrave joined the Company as CFO in April 2024, she is not a “Named Executive Officer” in respect of the fiscal year ended December 31, 2023 for purposes of this proxy statement, but Mr. Martin is a “Named Executive Officer” for such purpose.

LAWRENCE D. MARTIN, CPA, age 58, served as both Hallador’s CFO and President of Hallador’s subsidiary Sunrise Coal through April 9, 2024. From 2007 to 2017, Mr. Martin was Sunrise’s CFO. Prior to joining Sunrise, he worked for 19 years at CliftonLarsonAllen, LLP (CLA). Mr. Martin was a Senior Manager at CLA before his employment with Sunrise Coal. Mr. Martin is a graduate of Indiana State University and received his Bachelor of Science degree in Accounting in 1988.

HEATH A. LOVELL, age 49, has served as President of Hallador Power Company since 2022. Mr. Lovell will succeed Mr. Martin as President of Sunrise Coal. Prior to joining Hallador, Mr. Lovell was the Vice President – Public Affairs for Alliance Coal, LLC since June of 2017. Before that, he was Vice President of Operations for Alliance Coal covering Illinois, Indiana, and parts of Western Kentucky. He had been with Alliance Coal since 2006 and held several other positions including General Manager of River View Coal, LLC and General Manager of Webster County Coal, LLC. Mr. Lovell was responsible for the development of River View in 2009 with its nine units of operations and initial capital investment of $270 million. Before joining Alliance, Mr. Lovell was Vice President and Partner of Dodge Hill Mining, LLC. He has over 25 years of experience in the mining industry and holds a Master of Business Administration and a lawBachelor of Science degree in Electrical Engineering from the University of Wisconsin-Madison. He was awarded Honorary Doctorates degrees from the University of Wisconsin-Milwaukee, University of Wisconsin-Madison and the Medical College of Wisconsin.Kentucky.

Mr. Lubar, who controls 9.3% of our stock,Lovell has been on our board for ten years. Mr. Lubar is a very successful entrepreneur and sits on numerous boards inserved as the energy business along with Mr. Lawrence. With his 9.3% stake, he too has a vested interest in our success.

We believe that board members who are willing and able to have a sizable portion, or in some case a substantial portion, of their personal net worth invested in us tend to be conscientious directors. In other words, our directors’ interests are closely aligned with our shareholders’ interests. If our stock increases, our directors’ benefit directly and so do our other shareholders.

Officers are appointed by and serve at the discretionChairman of the Board.

8

Kentucky Coal Association Board of Directors, West Virginia Coal Association Board of Directors, Indiana Coal Association Board of Directors, Reliable Energy, Inc. Board of Directors, as well as a Board Member of the American Coal Council and its Committeesan appointed member of the National Coal Council.

EachMARJORIE HARGRAVE,age 60, joined Hallador on April 10, 2024 as our Chief Financial Officer. Ms. Hargrave has served as a director for Evolution Petroleum, a publicly traded company on the NYSE, since March 1, 2021 and currently serves as its Chair of the board members up for re-election attended at least 75% of the Board and Committee meetings (in person or by telephone) which he served during the year. We had nine Board meetings during 2017. Other Board actions were taken by written unanimous consent.

We do not have a specific policy regarding attendance at the annual shareholders meeting. All directors, however, are encouraged to attend if available. Two of our directors attended our 2017 Annual Meeting of Shareholders, one in person and one via conference call.

The Board has an Audit Committee, a Compensation and Nominating Committee, and an Executive Committee. The current charters for the Audit Committee, and the Compensation and Nominating Committee are available on our website, www.halladorenergy.com. The Board committee members, as of the date of this Proxy Statement, are identified in the following table:

|

|

|

| |

|

|

|

| |

|

| |||

|

|

|

| |

|

|

| ||

|

|

Audit Committee and Financial Expert

The Audit Committee met four times during 2017. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to:

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

All Audit Committee members are “independent” as defined by the Nasdaq listing standards, including those standards applicable specifically to audit committee members. In addition, noa member of the Audit Committee has served as one of our officers or employees at any time. All members of the Audit Committee are “non-employee directors” as defined in SEC rules.

9

Compensation and Nominating Committee

Our Compensation and Nominating Committee consists of four members. It held four meetings in 2017, and actions were taken by unanimous written consent. The purpose of our Compensation and Nominating Committee is to:

|

| ||

|

| ||

|

| ||

|

|

All Compensation and Nominating Committee members are “independent” as defined by the Nasdaq listing standards, including those standards applicable specifically to compensation committee members. In addition, no member of the Compensation Committee has served as one of our officers or employees at any time. All members of the Compensation and Nominating Committee are “non-employee directors” as defined& Corporate Governance Committees. Ms. Hargrave most recently was the President and CFO of Enservco Corporation, a publicly traded Oilfield Services Company. Ms. Hargrave is the former CFO of CTAP (currently owned by Marubeni-Itochu Tubulars America), a provider of pipe and tubing to the energy industry and the former CFO of High Sierra Energy, a midstream energy company that was sold to NGL Energy Partners. Previous assignments include VP Finance/Managing Director, Black Hills Corp., Finance Consultant, Xcel Energy; and VP Investment Banking, Merrill Lynch. Ms. Hargrave holds a Bachelor’s degree in SEC rules.economics from Boston University, a Master’s degree in economics from New York University, and certification in Cybersecurity Oversight from Carnegie Mellon University.

Executive Committee

Board Leadership and Structure

Chairman

Our Executive Committee did not meet during 2017. When the Board is not in session, the Executive Committee has all of the power and authority as delegated by the Board, except with respect to:

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

Code of Conduct

Our Board adopted the Company’s Code of Conduct, which provides general statements of our expectations regarding ethical standards that we expect our directors, officers and employees to adhere to while acting on our behalf. The Code of Conduct provides, among other things, that our directors, officers, and employees will: (i) comply with all laws, rules, and regulations applicable to us; (ii) avoid conflicts of interest; (iii) protect our assets and maintain our confidentiality; (iv) honestly and accurately maintain records and make required disclosures; and (v) promote ethical behavior and report violations of law, rules, regulations or the Code of Conduct.

The Code of Conduct is available on our website, www.halladorenergy.com.

Criteria for Director Nominations

General criteria for the nomination of director candidates include experience and successful track record, integrity, skills, ability to make analytical inquiries, understanding of our business environment, and willingness to devote adequate time to director duties, and diversity (although no formal policy exists, considered along with the aforementioned factors), all in the context of the perceived needs of the Board at that time. Stock ownership could also be a consideration.

10

Shareholder-Recommended Director Candidates

Our Board is responsible for identifying individuals qualified to become board members and nominees for directorship are selected by the Board. Although the Board is willing to consider candidates recommended by our shareholders, it has not adopted a formal policy with regard to the consideration of any director candidates recommended by our shareholders. The Board believes that a formal policy is not necessary or appropriate because of the small size of the Board and because the current Board already has a diversity of business background and industry experience. Our Board will consider director candidates recommended by shareholders who are highly qualified in terms of business experience and be both willing and expressly interested in serving on the Board. Shareholders recommending candidates for consideration should send their recommendations, including the candidate’s name, address, principal occupation, number of shares of Common Stock held by the proposed director candidate, and the recommending shareholder’s name, address and number of shares of common stock held, and any other information about the candidate’s qualifications to Hallador Energy Company, Attn: President, 1660 Lincoln Street, Suite 2700, Denver, Colorado 80264.

Submissions must include sufficient biographical information concerning the recommended individual, including age, educational background, employment history for at least the past five years indicating employer’s name and description of the employer’s business, and any other biographical information that would assist the Board in determining the qualifications of the individual. The Board will consider all candidates, whether recommended by shareholders or members of management. The Board will consider recommendations received by a date not later than 120 calendar days before the date our proxy statement was released to shareholders in connection with the prior year’s annual meeting for nomination at that annual meeting. The Board will consider nominations received beyond that date at the annual meeting subsequent to the next annual meeting.

The Board does not have a fixed policy regarding the separation ofroles for the roles of CEO and Chairman of the Board as our Board believes it is in our best interests to make that determination based on position and direction, and membership of the Board. Prior to the passing of our Chairman, Victor Stabio, on March 7, 2018, the position of CEO and Chairman were separate. Due to the unexpected passing of Mr. Stabio, our Board appointed Brent K. Bilsland to a combined role as Chairman, President("Chairman") and CEO on March 9, 2018

whether they should be served independently or jointly. Currently, Mr. Bilsland holds both positions. We see the dual role as a bridge between management and the Board. We believe that a Chairman who understands the day-to-day business and the important issues to be addressed by the Board is currently in the Company's and the shareholders' best interest. Our Board members have a small Board; therefore, its members concluded that Mr. Bilsland is best suited to serve as Chairman and CEO. The other directors have a signicantsignificant monetary stake in the Company which incentivizes them toand believe they can provide oversight of Mr. Bilsland’sto the combined role.

Director Independence

As required by Nasdaq rules, the Board will evaluate the independence of its members at least annually, and at other appropriate times when a change in circumstances could potentially impact a director’s independence or effectiveness (e.g., in connection with a change in employment status or other significant events). This process is administered by our Audit Committee, which consists entirely of directors who are independent under applicable Nasdaq and SEC rules. After considering all relevant relationships with us, the Audit Committee submits its recommendations regarding independenceDue to the fulllimited size of our Board, which then makeswe do not have a determination with respect to each director.Lead Independent Director.

In making independence determinations, our Audit Committee and Board consider relevant facts and circumstances, including (i) the nature of any relationships with us, either directly or asaddition, we have a partner, shareholder or officer of an organization that has a relationship with us, (ii) the significanceseparate Chair for each committee of the relationshipBoard. The Chair of each committee reports periodically to us, the other organizationBoard.

Independent and the individual director, (iii) whether or not the relationship is solely a business relationship in the ordinary course for us and the other organization and does not afford the director any special benefits, and (iv) any commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. For purposes of this determination, the Board deems any relationships that have expired more than three years ago to be immaterial.Non-Management Directors

After considering the standards for independence adopted by Nasdaq, the SEC, and various other factors as described herein, the Board has determined that all of our current directors and director nominees, other than Mr. Bilsland, are independent. Mr. David C. Hardie is the only non-employee director that receives compensation from us, which compensation is solely for his role as Chairman of our Audit Committee.

Director Compensation

Other than the Chairman of the BoardCyber Security Risk and the Audit Committee Chairman, our directors are not compensated for their services. During 2017, we paid Mr. Stabio $350,000 for his services, and he had 180,000 RSUs vest for a gross amount of $1,248,400.

Mr. Stabio had 220,000 RSUs vest upon his death on March 7, 2018 at a gross value $1,463,000.Information Oversight

We paid Mr. David C. Hardie $7,000 for his service as Audit Committee Chairmanrely on information technology to operate our business. We have endpoint and other protection systems, and incident response processes, both internally and through third-party consultants, designed to protect our information technology systems. These established processes assist us to continuously assess and identify threats to our systems and minimize impact to our business in 2017. Beginning 2018, Mr. David C. Hardie will receive $20,000 per year for his services as Audit Committee Chairman.the event of a breach or other security incident. With our third-party consultants, the processes protect our information systems and allow us to resolve issues timely. As new threats to security may be identified, our personnel are notified, with instruction to increase awareness of the threat and how to react if such a threat or actual breach appears to be encountered. Periodic educational notices are also disseminated to all personnel.

Audit Committee ReportAdditionally, as our systems are modified and upgraded, all personnel are notified, with instruction as appropriate. Responsibility for the identification and assessment of risks and the recommendation of upgrades to our systems resides with our expert consultants who report to our IT Director.

The Audit Committee evaluatesOur Board oversees the performance of EKS&H, LLLP (EKSH), including the senior audit engagement team, each year and determines whether to re-engage EKSH or consider other audit firms. In doing so, the Audit Committee considers the quality and efficiency of the services provided by EKSH and their technical expertise, tenure as our independent auditors and knowledge ofrisks involved in our operations as part of its general oversight function, integrating risk management into the Company’s compliance policies and industry. Based on this evaluation,procedures. With respect to cybersecurity, the Audit Committee decided to engage EKSH as our independent auditors for the year ended December 31, 2017. The Audit Committee reviewed with senior members of our financial management team and EKSH the overall audit scope and plans, and the quality of our financial reporting. The Audit CommitteeBoard has the sole authority to appoint the independent auditors.

Management has reviewed and discussed the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2017ultimate oversight responsibility, with the Audit Committee including a discussionand IT Steering Committee each having certain responsibilities relating to risk management of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant accounting judgments and estimates, and the clarity of disclosures in the financial statements. In addressing the quality of management’s accounting judgments, members ofcybersecurity. Among other things, the Audit Committee asked for management’s representationsdiscusses with management the Company’s major policies with respect to risk assessment and reviewed certifications prepared byrisk management, including cyber-security, as they relate to the CEOintegrity of the Company’s accounting and financial reporting processes and the CFOCompany’s compliance with legal and regulatory requirement. In addition to its other responsibilities, the IT Steering Committee oversees operational information technology risks, including cybersecurity, as they relate to the technical aspects of the Company’s operations. The IT Steering Committee and/or the full Executive Team receive at least quarterly reports from management on information technology matters, including cybersecurity. The reports address upgrades to hardware, software, and IT systems throughout the Company, and include the identification of IT and cybersecurity risks. Security scores, risk management, and mitigation measures are routinely presented. As discussed above, we maintain endpoint and other protection systems, and incident response processes, both internally and through third-party experts. As these systems, processes, training, and upgrades are implemented, updates are provided to the Executive Team. We have not identified an indication of a substantive cyber security incident that would have a material impact on our unaudited quarterly and audited consolidated financial statements fairly present in all material respects, our financial condition,business, results of operations and cash flows, and have expressed to both management and EKSH their general preference for conservative policies when a range of accounting options is available.or financial statements.

The Audit Committee believes that, by thus focusing its discussions with EKSH, it can promote a more meaningful dialogue that provides a basis for its oversight judgments.

The Audit Committee also discussed with EKSH those matters required to be discussed by the auditors with the Audit Committee under the rules adopted by the Public Company Accounting Oversight Board (PCAOB). The Audit Committee received the written disclosures and the letter from EKSH required by applicable requirements of the PCAOB regarding EKSH's communication with the Audit Committee concerning independence, and has discussed with EKSH their independence.

In performing all of these functions, the Audit Committee acts in an oversight capacity. The Audit Committee reviews our quarterly and annual reports on Form 10-Q and Form 10-K prior to filing with the SEC. In its oversight role, the Audit Committee relies on the work and assurances of management, which has the primary responsibility for establishing and maintaining adequate internal control over financial reporting and for preparing the financial statements, and other reports, and of EKSH, who are engaged to audit and report on our consolidated financial statements.

In reliance on these reviews and discussions, and the reports of EKSH, the Audit Committee has recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2017, for filing with the SEC.

MEMBERS OF THE AUDIT COMMITTEE:

David C. Hardie – Chairman of the Committee

Bryan H. Lawrence

Sheldon B. Lubar

12

Our Board has ultimate responsibility for general oversight of risk management processes. The Board receives regular reports from Mr. Bilsland on areas of risk we face. Our risk management processes are intended to identify, manage, and control risks so that they are appropriate considering our scope, operations, and business objectives. The full Board engages with the appropriate members of management to enable its members to understand and provide input and oversight of our risk identification, risk management, and risk mitigation strategies. The Audit Committee also meets without management present to, among other things, discuss our risk management culture and processes. In the event, a committee receives a report from a member of management regarding areas of risk, the Chairman of the relevant committee will report on the discussion to the full Board to the extent necessary or appropriate. This enables the Board to coordinate risk oversight, particularly concerning interrelated or cumulative risks that may involve multiple areas for which more than one committee has responsibility.

Compensation Committee Risk AssessmentCode of Conduct

The Compensation Committee reviewed and discussed an internal risk assessmentOur Board adopted the Company's Code of Conduct, which provides general statements of our executiveexpectations regarding ethical standards that we expect our directors, officers, and non-executive compensation programs and the outcomes of such assessment. Based on such review, the Compensation Committee believes that our compensation programs (i) do not motivate our executives or our non-executive employees to take excessive risks, (ii) are aligned with shareholders’ best interests, and (iii) are not reasonably likelyadhere to have a material adverse effect on us. Our compensation programs are designed to support, reward appropriate risk-taking, and include the following:

|

|

|

|

Policy for Approval of Related Person Transactions

The Audit Committee is responsible for reviewing and approving all related person transactions by our written policy. Such transactions are generally reviewed before entry into the related person transaction. In addition, if any of our specified officers or directors becomes aware of a related party transaction that has not been previously approved or ratified, such related person transaction will be promptly submitted thereafter to the Audit Committee for its review. In reviewing a transaction, the Audit Committee considers the relevant facts and circumstances, including the benefits to us, any impact on director independence and whether the terms are consistent with a transaction available on an arms-length basis. Only those related person transactions that are determined to be in (or not inconsistent with) our best interests are permitted to be approved. No member of the Audit Committee may participate in any review of a transaction in which the member or any of his or her family members is the related person.

Good corporate governance is a priority to us. Our key governance practices are outlined in our committee charters, and Code of Conduct. These documents can be foundwhile acting on our website, www.halladorenergy.com by clicking on “Corporate Governance,” and are available in print to any shareholder, without charge, upon request. Information on our website is not considered part of this Proxy Statement.behalf. The Code of Conduct applies toprovides, among other things, that our directors, executive officers, and employees will: (i) comply with all laws, rules, and regulations applicable to us; (ii) avoid conflicts of interest; (iii) protect our other personnel. Any updatesassets and maintain our confidentiality; (iv) honestly and accurately maintain records and make required disclosures; and (v) promote ethical behavior and report violations of laws, rules, regulations or amendments to the Code of Conduct will be posted on the website.Conduct.

The Audit CommitteeCode of Conduct is available on our website, www.halladorenergy.com.

Board Meetings and CompensationAttendance

During 2023, the Board held seven regular meetings, and Nominating Committeeeach of the committees held the number of meetings included in the description of the committees set forth below. Each Board member up for re-election attended at least 75% of the Board are responsible for reviewing the Corporate Governance Guidelines annually and reporting and making recommendations to the Board concerning corporate governance matters.

Shareholder Communications with our Boardcommittee meetings, which they served on during 2023.

We invite shareholders to send written communications to the entire Board or to individual Board members. Please send your letter in care of the Chairmando not have a specific policy regarding attendance at the address shown on the front pageannual meeting of this Proxy Statement.

If a shareholder communication raises concerns about management or our ethical conduct, you can report it confidentially by e-mail at http://www.openboard.info/hpco/ or by telephoneshareholders. All directors, however, are encouraged to 866-229-6923. The communications submitted through this hotline are forwarded to the Chairmanattend if available. All of our Audit Committee and, if appropriate,directors participated in the Audit Committee will take such actions as it authorizes to ensure that the subject matter is addressed by the appropriate Board committee, management and by the full Board.

13

If a shareholder or other interested person seeks to communicate exclusively with our non-management directors, such shareholder communication should be sent directly to Mr. David C. Hardie, Chair of the Audit Committee, at the Company’s address.

At the direction of the Board, we reserve the right to screen all materials sent to the directors for potential security risks, harassment purposes or routine solicitations.

Shareholders have an opportunity to communicate with the Board at our2023 Annual Meeting of Shareholders.

Executive Sessions of Non-Management Directors

To promote open discussions, our non-management directors meet in executive sessions regularly after scheduled Board meetings.

Our Board has three separately designated standing committees: an Audit Committee, a Compensation Committee, and a Nominating Committee. The Chairman shallcommittee charters are available on our website, www.halladorenergy.com.

The membership and purposes of each of the committees are described below.

Audit Committee | |||

David C. Hardie Chair and Financial Expert Bryan H. Lawrence David J. Lubar | All of our Audit Committee members are "independent" as defined by the Nasdaq listing standards, including those standards applicable specifically to audit committee members. Also, no member of the Audit Committee has served as one of our officers or employees at any time. All members of the Audit Committee are "non-employee directors" as defined in SEC rules. In addition to regularly scheduled meetings, the committee meets separately in executive sessions with representatives of our independent auditor. The Audit Committee approves the appointment and services of the independent auditor and reviews the general scope of the audit and audit-related services, matters relating to internal controls, and other matters related to accounting and reporting functions. The Audit Committee assists the Board in fulfilling its oversight responsibilities concerning: | ||

(i) | The integrity of the financial reports and other financial information provided by us to the public or any governmental body; | ||

(ii) | our compliance with legal and regulatory requirements; | ||

(iii) | our systems of internal controls over financial reporting; | ||

(iv) | the qualifications and independence of our independent auditors; | ||

(v) | our auditing, accounting, and financial reporting processes generally; and | ||

(vi) | the performance of such other functions as the Board may assign from time to time. | ||

To this end, the Audit Committee maintains free and open communication with the Board, the independent auditors, and any other person responsible for our financial management. The Board also determined that Mr. David C. Hardie qualifies as an audit committee financial expert under the applicable SEC rules. | |||

The Audit Committee met four times in 2023. |

Compensation Committee | |||

David J. Lubar Chair David C. Hardie Steven R. Hardie Bryan H. Lawrence | All of our Compensation Committee members are "independent" as defined by the Nasdaq listing standards, including those standards that apply specifically to compensation committee members. Also, no member of the Compensation Committee has served as one of our officers or employees at any time. All members of the Compensation Committee are "non-employee directors" as defined in SEC rules. The purpose of our Compensation Committee is to: | ||

(i) | oversee our executive and director compensation; and | ||

(ii) | oversee and administer our stock incentive plans. | ||

The Compensation Committee met once in 2023. | |||

Nominating Committee | |||

Charles R. Wesley, IV Chair David C. Hardie Steven R. Hardie Bryan H. Lawrence David J. Lubar | No member of the Nominating Committee has served as one of our officers or employees at any time. All members of the Nominating Committee are independent, as defined in SEC rules. The purpose of our Nominating Committee is to: | ||

(i) | assist our Board by identifying individuals qualified for election and re-election as Board members and to recommend to our Board, the director nominees for each annual meeting of shareholders, subject to the provisions of any shareholder or similar agreement binding on us; and | ||

(ii) | recommend to the Board director nominees for each committee of the Board, subject to the provisions of any shareholder or similar agreement binding on us, and act on specific matters within its delegated authority, as determined by the Board from time to time. | ||

The Nominating Committee did not meet in 2023. | |||

Criteria for Director Nominations

General criteria for the nomination of director candidates include experience and successful track record, integrity, skills, ability to make analytical inquiries, understanding of our business environment and willingness to devote adequate time to director duties, diversity (although no formal policy exists, considered along with the aforementioned factors), all in the context of the perceived needs of the Board at that time. Stock ownership could also be a consideration.

The Company seeks to maintain a Board comprised of talented and dedicated directors with a diverse mix of expertise, experience, skills, and backgrounds. The skills and backgrounds collectively represented on the spokespersonBoard should reflect the diverse nature of the business environment in which the Company operates. Although the Company has not adopted a formal diversity policy for the Board, exceptas new members of the Board are considered, diversity considerations should include - but not be limited to - business expertise, geography, age, gender, and ethnicity.

The Company is committed to a merit-based system for Board composition within a diverse and inclusive culture which solicits multiple perspectives and views and is free of conscious or unconscious bias. When assessing Board composition or identifying suitable candidates for appointment to the Board, the Company will consider candidates on merit with due consideration to the benefits of diversity and the needs of the Board. Prior to recommending the director slate this year, our Nominating Committee conducted a broad search for new director candidates, and reviewed and considered candidates from a variety of backgrounds, including female candidates and other candidates that would have qualified as diverse under the Nasdaq Board Diversity Rule. Taking into account these various factors, our Nominating Committee determined to recommend Mr. Gray as a new director nominee to our Board, and to nominate each of our continuing directors, other than Mr. Steven Hardie who, as noted above, is not standing for re-election this year and will retire from the Board at the Meeting.

The Nasdaq Board Diversity Rule requires companies listed on Nasdaq to publicly disclose board-level diversity statistics using a standardized template. Our current Board Diversity Matrix is set forth below. Beginning this fiscal year, smaller reporting companies like our Company must also either have or explain why they do not have at least one diverse director on their board of directors. As of the date hereof, we do not satisfy the diversity objective under the Nasdaq Board Diversity Rule. We believe that the current composition of our Board is and, upon election of the proposed slate of director nominees at this year’s Meeting, will be appropriately balanced in circumstances whereskills and experience in light of the inquiry or comment isCompany’s current business environment and the challenges currently facing the Company and the coal and electricity markets in general; as such, we do not currently have at least one diverse director on the Board.

The Board Diversity Matrix sets forth information about the Chairman. Indiversity of the Board in accordance with the recently adopted NASDAQ Board Diversity Rule.

Board Diversity Matrix (as of April 12, 2024) | ||||

Total Number of Directors: | 6 | |||

Part 1: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

Directors | - | 6 | - | - |

Part 2: Demographic Background | ||||

African American or Black | - | - | - | - |

Alaskan Native or Native American | - | - | - | - |

Asian | - | - | - | - |

Hispanic or Latino | - | - | - | - |

Native Hawaiian or Pacific Islander | - | - | - | - |

White | - | 6 | - | - |

Two or More Races or Ethnicities | ||||

LGBTQ+ | ||||

Did Not Disclose Demographic Background | ||||

As of December 31, 2023, Hallador and its subsidiaries employed 936 full-time employees and temporary miners, 886 of those employees and temporary miners are directly involved in the coal mining or coal washing process. Our coal workforce is entirely non-union. To attract and retain top talent, we provide competitive wages, an annual bonus for all employees, excellent benefits, an employee health clinic and a culture that is committed to health and safety at all levels.

Employee health and safety is a top priority at our wholly owned subsidiary, Sunrise Coal. With a robust safety department and safety standards that exceed mandated guidelines, we make safety the foundation of everything we do. While every precaution is taken to prevent mine emergencies, Sunrise Coal has its own private mine rescue team. This team is trained and ready to manage emergency situations at a Sunrise Coal facility, but also ready and available to assist other mine rescue teams. We continuously monitor safety data such instances,as injury severity, violations per inspection day, and significant and substantial citations.

We are committed to providing comprehensive affordable health insurance with low-cost deductibles and co-pays to take care of our employees and their families. We believe in decreasing the Chairmanbarriers to healthcare, so employees and their dependents do not have to delay care. Our employees and their families also have access to a private full-time health and wellness clinic, with free medications, no cost diagnostics, and a wellness coach.

Beyond investing in the safety and health of its employees, we invest in educational opportunities for our employees. All continuing education requirements and training are completely paid for by our Company and tuition reimbursement programs are available to every employee company wide.

Engagement with our shareholders helps us gain useful feedback on a wide variety of relevant topics pertaining to the operations, governance and strategy of our Company. If such feedback is received, it is shared regularly with the Company’s management and the Board and may be considered in setting the governance practices and strategic direction for the Company.

The Company from time to time interacts and communicates with shareholders in a number of forums, including quarterly earnings calls and webcasts, SEC filings, meetings and press releases. The Company is committed to constructive communication and engagement with shareholders.

Shareholders who wish to contact our Board or any individual director regarding Hallador may do so by mail addressed to our Corporate Secretary at Hallador Energy Company, 1183 East Canvasback Drive, Terre Haute, Indiana, 47802. Relevant communications received in writing are distributed to our Board or to individual directors, as appropriate, depending on the facts and circumstances outlined in the communication received.

Anti-Hedging and Anti-Pledging Policy

We maintain an insider trading policy that applies to our officers and directors that prohibits trading our securities when in possession of material non-public information. It prohibits the hedging of our securities, including short sales or purchases or sales of derivative securities based on our securities, and, unless our Audit Committee approves an exemption, the pledging of our securities. Since the adoption of our insider trading policy, the Audit Committee has not granted any such exemptions to the policy's general prohibition on pledging.

We have not adopted a formal stock ownership policy for our Named Executive Officers, but through existing stock ownership and the vesting of the restricted stock units, they hold a significant portion of our outstanding shares of Common Stock.

Compensation Recovery ("Clawback") Policy

We adopted a compensation recovery "clawback" policy as required by Rule 10D-1 under the Securities Exchange Act of 1934, as amended, and the corresponding rules adopted by Nasdaq, which provides for the mandatory recovery of certain erroneously awarded incentive compensation from our officers in the event of an accounting restatement to correct the Company’s material noncompliance with any financial reporting requirement under securities laws.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 and related regulations require our Section 16 officers and directors and persons who beneficially own more than 10% of our Common Stock to file with the SEC. We believe all of these reports were timely filed based upon our review of the reports filed with the SEC, with the exception of Todd Davis, Chief Accounting Officer through December 1, 2023, who was late reporting one transaction in December 2023. The transaction was reported on Form 4 filed on December 28, 2023.

Beginning in 2023, each of our non-employee members of our Board, with the exception of Mr. Lawrence, who declined being compensated for his Board role, receives an annual retainer of $50,000 and each chair of the Audit Committee, shall become the spokesperson.Compensation Committee and the Nominating Committee receives an additional retainer of $25,000.

INFORMATION ABOUT OUR NON-DIRECTOR NEO2023 Director Compensation Table

LAWRENCE D. MARTIN, age 52, CPA, isThe following table sets forth information concerning the compensation paid to the non-employee members of our Chief Financial Officer and Chief Accounting Officer. In 2017 he was promoted to PresidentBoard during the fiscal year ended December 31, 2023:

Director Name | Fees Earned(1) | Total | ||||

Brent K. Bilsland | $ | -- | $ | -- | ||

David C. Hardie | $ | 75,000 | $ | 75,000 | ||

Steven R. Hardie | $ | 50,000 | $ | 50,000 | ||

Bryan H. Lawrence | $ | -- | $ | -- | ||

David J. Lubar | $ | 75,000 | $ | 75,000 | ||

Charles R. Wesley, IV | $ | 75,000 | $ | 75,000 | ||

____________ | ||||||

(1) Such amounts were earned in 2023, and paid in March 2024. | ||||||

PROPOSAL NO. 2: APPROVE, ON AN ADVISORY VOTE APPROVINGBASIS,THE NAMED EXECUTIVE OFFICERS’OFFICERS' COMPENSATION.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" HALLADOR'S NAMED EXECUTIVE OFFICERCOMPENSATION.